Moving a container from China to the US has gotten expensive these days, a lot more expensive. For mid-sized importers, spot and premium rates – rates that actually get an empty container to your factory or warehouse loading dock and a confirmed sailing date – may be 3 to 4 times higher than last year’s already inflated levels. And this may not change anytime soon as demand continues to outstrip supply. We’ll leave our ocean rate crystal ball and service provider strategy suggestions for another Brief. Instead, our focus here is on practical steps you can take to prepare your supply chain for the possibility of a prolonged period of historically high ocean rates.

Triple-digit rate increases

Container shipping rates on the major global trade lanes are up dramatically this year, on average 360% according to Drewry’s World Container Index[1] as of mid-August. On key trade lanes the firm reports year-over-year increases from Shanghai to Los Angeles and New York at 242% and 284% respectively, while Shanghai to Rotterdam is up 659%. Moreover, we have seen individual shippers pay substantially more than these averages in recent days – ‘premium’ rates nearing $25,000 for a 40ft container – to secure a container and a vessel slot from China/East Asia to the US West Coast.

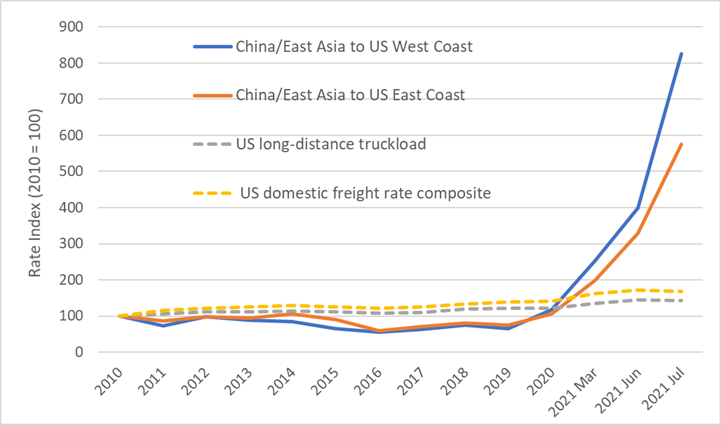

Looking back over the past ten years, rates to move a box eastbound on the Transpacific had rocketed by over 700% to the West Coast as of the end of July, inclusive of the near-mandatory premium surcharges. In contrast, a composite index of US domestic transportation rates is up ‘only’ 69%.

Ocean and US domestic Transport Rate Indices, 2010 to 2021[2]

Actions to consider

While history suggests an eventual return to a lower rate environment, timing and where rates will land is of course the great unknown. But there are actions importers can take now to help mitigate these increased costs should they persist. At the same time, these steps will increase your supply chain efficiency and resiliency no matter which direction ocean freight rates head.

1. Increase container cube utilization

A great place to start is at your own receiving dock. Take a look at the inbound ocean containers when the doors are opened. Is there empty space above and beside the pallets of product? Does the product fill the entire pallet footprint? Shipping air is expensive, especially today. Look to re-engineer how products are stowed in the container. Consider alternative packaging options, co-loading other products, and switching to floor loading or slip sheets rather than pallets – all to optimize container cube utilization. You can also offer incentives to your customers to order in quantities that cube out containers.

With today’s dramatically higher ocean freight rates, the payoff from these alternatives may now be quite attractive.

2. Be on the lookout and stay flexible

Work closely with your forwarder – and ensure you have the right forwarder – to find alternative load ports, destination ports and inland routings to your final destination. With the volatility of spot ocean rates across lanes and carriers, a longer inland dray may still yield a lower total transport cost, particularly given the divergent rate trajectories of ocean versus domestic transport. If your shipment isn’t super urgent, you could also consider finding an economical storage option near the origin port while you are on the lookout for a more cost-effective booking.

With so many factors at play and changing by the hour – rates, container availability, sailing schedules, factory and port closures, port congestion, bad weather – it is more important than ever to be in close communications with your carriers, forwarders, dray operators and 3PLs. Supply chain visibility tools are available to facilitate information flow and proactive decision making. But gaps are inevitable. In our recent work with importers, some seemingly old-school actions such as standing up daily calls with your key supply chain partners and sharing ad hoc tracking spreadsheets can make a material difference in keeping your freight moving and out of trouble.

3. Update warehouse service regions and routing guides

In a recent US warehouse network design study for a client importing metal products from China, we found that increasing ocean rates into both the West and East Coasts of the US favored directing more volume through its western DC. That is, when we tested how increases in these inbound ocean rates impacted the network design, we found that the optimal service territory for its West Coast DC extended to more customers in the Mid-Central region, for example, that would normally be shipped from its Southeastern DC.

When major elements of distribution cost change, such as ocean transport, including the relative differences between West/East Coast or all-water vs intermodal, it is a good time to reconsider your network nodes and flow paths to see what changes might make financial sense. By testing the sensitivity of your current distribution network to cost changes (e.g., transport, labor, real estate and materials), you will be prepared to take actions should your ‘what ifs’ become reality.

4. Design for distribution

Some companies are relooking at how their products are designed – to improve both manufacturability and distribution economics. This requires convincing product development teams to include supply chain and logistics professionals earlier in the design process. Considering stackability, pallet loading configurations and container cube utilization can significantly reduce transport and warehousing costs.

5. Source locally

With ocean rates so high and likely to stay that way for an extended period, the net landed cost of your current China-sourced product may now exceed that of locally-sourced supplies. And that’s before adding the opportunity cost of lost sales due to container arrival delays. Savvy companies are launching major sourcing projects, reaching back to suppliers they have previously considered and casting a wide net to find others, particularly in Mexico but also in the US.

6. Localize product assembly

For some products, the fully-assembled product in its final consumer-ready packaging will consume considerably more cube than a partially-assembled set of components tightly nested in shipping cartons. Hence, it’s possible that with higher ocean rates, repositioning final product assembly, consumer packaging operations and some component sourcing to the destination region may yield a lower total landed cost. While labor costs are higher in the US than in China (the overall gap has been shrinking), transport cost savings may now offset this delta. Automation can also help. Or consider an assembly operation in an economic development zone or in Mexico. These final assembly or kitting operations can even be co-located in your distribution centers. This may also drive service improvement – a configured-to-order product can be shipped quickly to your customers.

7. Reshore production to North America

Faced with geopolitical risks, rising freight costs, increased transit times and lower reliability[3], manufacturers are reassessing their global manufacturing options. If reshoring some Asian manufacturing back to the US or Mexico could previously be justified only on a risk mitigation or lead-time reduction basis, persistently high ocean rates could tip the scales.

Finally, if you haven’t conducted an end-to-end supply chain network analysis recently – considering sourcing, manufacturing and distribution – you may find significant opportunities to mitigate costs, improve service and increase revenue. There are quick wins available and clear actions to take, regardless of how rates evolve.

[1] Drewry’s World Container Index, August 19, 2021.

[2] UNCTAD, Freightos (including premium surcharges), St. Louis Federal Reserve FRED Economic Data, Cass implied freight rates, and NHC analysis.

[3] See “Time for an inventory system tune-up?,” New Harbor Consultants Brief, May 14, 2021

* * * * *

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com.

David Frentzel is a Partner at New Harbor Consultants. Dave brings 30 years of management consulting and hands-on executive leadership experience to improve business outcomes. Prior to joining New Harbor, he held various senior positions at 3PL and supply chain technology companies. Dave has extensive global management expertise having spent more than ten years living and working internationally helping companies with their global go-to-market, organizational, sourcing, manufacturing, and supply chain strategies and operations.