The coronavirus pandemic has revealed the vulnerability of many global supply chains. Supply plummeted first from shutdown factories in China, then demand collapsed worldwide as countries adopted stay-at-home orders. These unprecedented events surfaced a level of supply chain risk and lack of resiliency that drove many supply networks to the breaking point.

Companies now face an urgent opportunity to reconsider the balance between supply assurance and low cost. Now is the time, we believe, to de-risk the supply chain, adopting strategies and tactics that drive a better risk-reward solution. Our Brief presents specific actions that can ensure your company’s operations benefit from robust planning and execution, by raising supply chain resilience and reducing supply chain risk.

* * * * *

Supply chains have grown longer and more complex as they have expanded globally. At the same time, tight planning and lean inventories have fueled just-in-time fulfillment. In normal times, these policies deliver lower operating costs, reduced working capital and faster introduction of new products – all good for the bottom line. But the coronavirus exposes the importance of including supply chain risk in the equation. While there are no easy answers, there are frameworks for thinking about how to manage risk more effectively. Boards and CEOs are perhaps more open now than ever to de-risking the supply chain – as long as returns are not unduly sacrificed.

The key is to address supply chain risk on two levels: First, reconsider your basic supply-to-market strategy to ensure you are following the course that best supports your business. Second, determine the right tactics to complement and support it. To do this right companies must have a firm grip on their core strategies, invest in new forms of analysis such as portfolio modeling, and be willing to make decisions that fly in the face of organizational precedent.

Strategic approach to de-risking

To effectively balance supply chain risk and opportunity, product manufacturers, distributors and retailers need to periodically rethink their supply chain strategies. Conceptually, there are two ways to address the burgeoning nature of risk. You can shorten the supply chain in order to reduce cycle time and disruption risk, or you can optimize the portfolio of supply chain sources and locations in order to gain flexibility through diversification.

The first approach has been used effectively by some innovative companies. Examples include Herman Miller in office furniture and Room and Board in home furnishings, both of which limit their offshore supply in favor of domestic sourcing. But this has its limits, potentially forsaking the economic benefits of extending the supply chain globally.

The second strategic move can offer some as-yet untapped advantages. The idea of optimizing a company’s portfolio of sources, assembly and distribution points derives from financial portfolio theory and offers a valuable framework for assessing risk/return tradeoffs. The goal here is to create a supply chain strategy that best fits the overarching needs of the firm through a process of modeling that shows decision-makers the benefits and risks of different product sourcing and flows. Firms can employ portfolio modeling to mix and match different tactics in pursuit of the arrangement of sources, locations, inventories and services that maximizes the supply chain’s ability to support a specific company strategy.

De-risking on the efficient frontier

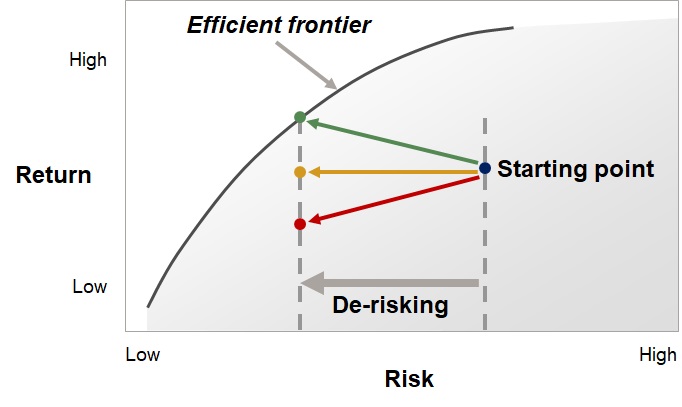

Creating a portfolio starts with developing a set of alternative supply chain designs that support the business in different ways. For example, one approach might emphasize speed-to-market, another might focus on manufacturing quality, a third on cost. In parallel, supply chain risks associated with each approach are identified, classified, and quantified. The projected returns and risks can then be modeled and plotted on a spectrum, as shown below. The optimal solution will lie along the “efficient frontier” in this space, representing the set of options with the highest return for a given level of risk. The key here is to combine supply chain elements whose disruption risks are not directly correlated. In other words, you are seeking to minimize the likelihood of a domino effect in which a problem at one stop in the supply chain imperils others. In the example below, you want to reduce risk without sacrificing efficiency. The best risk-reducing strategy is the one that boosts returns on the efficient frontier – the green path.

Alternative supply chain risk reduction solutions

Modeling and visualizing possible supply chain risk-reward options is valuable. Managers can update costs, risks, and other data in the model and periodically convene a group of decision makers from other functions to revisit supply chain strategy decisions or test new concepts. This ensures that executives from across the organization understand the alternatives and tradeoffs and commit to successful implementation.

Portfolio modeling offers several advantages. First, it is understood and practiced by CFOs and allows supply chain executives to make the case about risk in terms that senior management understands. Second, it appropriately focuses on the business value that supply chain management can deliver – through satisfied customers, capital efficiency, and low operating costs – for a given level of risk. This framework can also adapt to changes in supply chain strategy considering shifts, over time, in relative costs and perceived risks. Given the experience of the coronavirus, we believe de-risking is a priority for many companies.

Tactics to consider to reduce supply chain risk

Once the strategy is decided, there are numerous opportunities to reduce risk. Here is a 10-point primer on practical steps that any company can take:

Demand management:

- Improve demand planning with distributors and retailers by being closely connected to customers through shared demand forecasts, vendor-managed inventory, and other joint systems. At the same time, track leading indicators of demand trends relevant to your industry. The goal is to reduce the risk of being blindsided by demand shifts, even if not of the magnitude experienced during the coronavirus.

Supply management:

- Work with suppliers to create contingency plans. Companies with such plans have been much better able to weather crises. During the pandemic, Hershey’s quickly augmented stocks of vital ingredients and finished goods. In the wake of 9/11, Continental Automotive activated its contingency relationships with logistics providers to speed air shipments of parts from Europe.

- Diversify sourcing to reduce the risk of catastrophic supply chain failure. Establish backup arrangements by qualifying additional suppliers, even without awarding them significant volume. Many companies have adopted a dual sourcing policy, for instance complementing China with a Mexican source. The challenge is to find the right mix of products and volumes that leverages the diversification with the minimum loss of efficiency – or even a gain. Volume flexibility should be built into service level agreements.

- Localize to shorten the supply chain. This may mean nearshoring production. For companies with US processing, the lower risk inherent in a distributed, decentralized system of regional plants may offer advantages. Faster fulfillment of orders and ability to pivot to demand are key. And expanded use of robotics can deliver efficiency even at smaller scale.

Logistics enhancement:

- Employ a major third-party logistics provider with broad resources to deal with contingencies. One electrical manufacturer asked its freight forwarder to provide weekly updates on the best US ports for its inbound product flows from Asia during a dockworker lockout. The logistics provider became a key risk-mitigation agent by continually looking over the horizon on its client’s behalf.

- Strategically build inventories, by modeling and optimizing on a disaggregated basis. All components are not created equal. Modeling supply susceptibility to delays leads to finer tuning of safety stocks, which may rise for some parts or finished goods but fall for others. A typical product with a one-week lead time and delivery variability of one day will require 15% more safety stock, for example, if supply variability increases by one day, and 175% more if variability rises by a week. Which items are most critical to your company’s sales?

Supply chain integration:

- Reduce complexity in the product line and components. Simplified offerings can reduce costs, raise productivity and grow revenues. As well, component standardization across multiple suppliers and plants allows such manufacturers as Apple, HP and Herman Miller to make their supply chains more flexible. Reducing product complexity shortens cycle times in normal conditions and adds resilience during supply crises. Creating a centralized product database helps reduce the risk of disruption, since substitutes can be rapidly located. Companies that have sole-sourced a key component for years without controlling the engineering drawings, take heed.

- Raise visibility along the extended supply chain. When inventory is tracked from order placement to receipt at a forward distribution center or customer, it can effectively become part of a company’s safety stock. Achieving real-time knowledge of parts and products location as they flow from distant origins is not easy, to be sure, but trade management supply chain visibility software can help track global goods flows and help divert shipments when necessary.

- Secure vital infrastructure and services. This ranges from cybersecurity measures to back-up electricity supplies and a crisis response team. And extend insurance policies to cover overseas suppliers. Contingent business interruption coverage, for example, is typically limited to the US and nearby countries. It should be explicitly extended to cover major suppliers located in Asia and other low-cost geographies.

- Monitor specific warning signs of trouble. Tracking a limited number of supply chain risk indicators such as weeks of orders outstanding, component delivery time variability and average train speeds can provide a crucial warning as a problem approaches the tipping point. Most firms should amend their current operational dashboards to include more external and internal risk factors than they typically track today.

Changing the mindset

Managers that use an appropriate mix of the initiatives outlined can expect to see real improvements in their supply chain performance – during ‘normal’ and ‘exceptional’ times. Of course, incorporating risk considerations into what have historically been highly cost-focused analyses requires a shift in thinking and organizational behavior. To improve the risk/reward equation, compartmentalized decision making must be replaced by cross-functional collaboration. Participants can come from Marketing, Sales, Sourcing, Manufacturing, Supply Chain, Finance and Risk Management. Direct involvement of the CEO or COO will drive the best effort across these activities.

The long-term trend toward just-in-time delivery combined with strong economic incentives to access the lowest-cost global supply sources virtually guarantees abundant risks throughout the supply chain. Revisiting the risk-reward efficient frontier is now a top priority. Supply chain teams can contribute by identifying, quantifying and preparing for the new realities of supply chain risk.

* * * * *

Notes:

- For more detail on supply chain challenges in the time of the coronavirus, see these New Harbor Briefs on our website: Toilet paper: The pandemic paradox, and The food supply chain — What’s changed and what lies ahead?

- This Brief owes a debt to an earlier article by the author: Balancing Global Risk and Return, in Harvard Supply Chain Strategy Newsletter, August 2005.

- For the seminal work on building resilience into companies’ supply chains, see The Resilient Enterprise by Prof. Yossi Sheffi of MIT.

Contact us to explore how we can support your strategic, operational and investment needs: info@newharborllc.com.

David Bovet is the Managing Partner at New Harbor Consultants. He focuses on helping clients translate their supply chain vision into practical results. David brings 30 years of experience across a range of industries and geographies. Projects focus on strategic direction, operational improvement and hands-on implementation. He is the co-author of Value Nets: Breaking the Supply Chain to Unlock Hidden Profits, about the power of fast and flexible logistics-intensive business models.