Given today’s volatile costs and service levels across the global supply chain, complete and timely product costs are even more critical to your company’s sourcing strategies and day-to-day purchasing decisions. Make-vs-buy and supplier selection decisions depend on understanding and comparing alternatives considering all relevant product costs – typically referred to as the total landed cost, or simply landed cost. The term generally refers to imported products, but is applicable to all products. Not getting landed cost right can affect your company sales, profits and even access to a reliable source of supply.

In this Brief, we highlight several supply chain trends that are driving companies to take a fresh look at their landed cost, provide a practical definition, and suggest several actions to improve sourcing decisions.

Cost and service volatility in the supply chain

For many companies, the high landed cost and poor service levels associated with accessing overseas-made components and finished goods in recent years – often from China – has been a primary driver in reconsidering product sourcing.

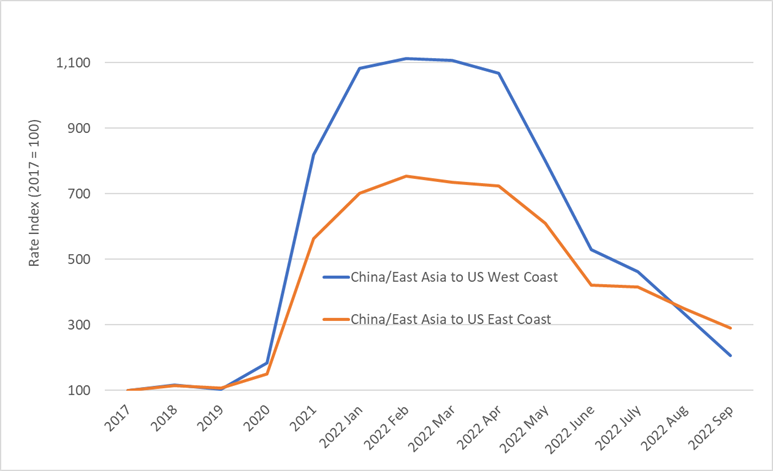

For example, Transpacific eastbound container shipping rates have been on a wild ride over the past two years. While down from the 2021 peaks, current rates are still two to three times pre-pandemic levels, according to the Freightos ocean freight indices as of the end of September.

Ocean Container Transport Rate Indices, 2017 to 2022

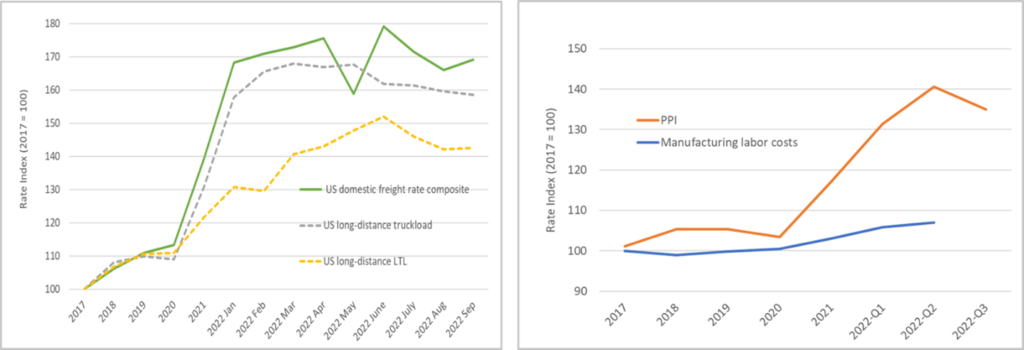

US transportation and manufacturing have also entered a period of elevated costs and volatility.

Figure 2: US Transportation Costs Figure 3: US Manufacturing Costs

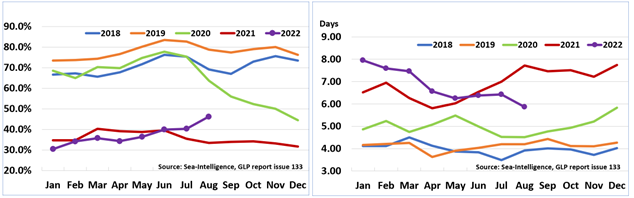

And what about the cost impact of the increased supply risk for an overseas vs a domestic supplier? Ocean container transit times and reliability have plummeted since mid-2020, though they are now improving. Delays and uncertainty drive more safety stocks and warehouse space across the distribution network to maintain high customer order fill rates.

Figure 4: Ocean Carrier Schedule Reliability Figure 5: Global Delays for Late Vessel Arrivals

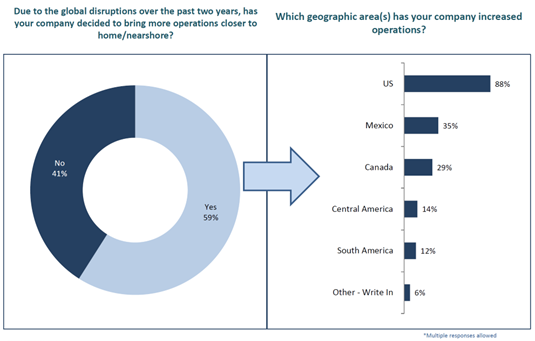

Faced with these challenges, supply chain managers are actively reconsidering their sourcing options, especially reshoring manufacturing and adding more US suppliers (Figure 6). For these kinds of sourcing decisions, having a firm grasp of net landed cost is critical.

Figure 6: Supply Chain Disruption Driven Reshoring

Key components of landed cost

Landed cost consists of five major components:

- Product. Product purchase price includes materials, labor and profit. Rebates and volume discounts should be factored in. Manufacturing cost is used for internally-produced items.

- Transportation. This is the cost to pack and move the product to your customer-facing distribution center or to the final customer. Freight charges represent the largest chunk, but surcharges, carrier assessorials, port charges, and detention & demurrage fees are included too. With recent roller coaster freight rates, including premium and peak season surcharges, product transportation costs may lag the market reality.

- Customs. This includes applicable duties, tariffs, taxes and customs brokerage fees.

- Overhead. Costs include supplier qualification, purchasing activities, and overseas buying offices, for example. Overhead costs apply to both imported and domestically-sourced products as well as to in-house production, albeit at different burden rates.

- Risk. Insurance, quality, and compliance costs are included here. The added risk associated with a less-reliable product source or transport solution is typically captured in the additional safety stock needed to maintain customer service levels. More stock consumes working capital at a higher financing cost due to today’s increasing interest rates – and increases warehouse space, insurance, and product obsolescence costs.

Geopolitical risks loom large today as well, for example a high concentration of suppliers in a single region or country. Applying a hard cost to this type of risk is impractical, rather we recommend classifying items into risk categories – the high-ranking ones to be prioritized for sourcing review.

Actions to consider

To ensure that the best possible sourcing decisions are made, landed cost must be timely and accurate, incorporating all the key cost components. If you haven’t comprehensively considered landed cost recently, we recommend the five actions outlined below.

1. Profile your current supply base

Start with the most critical materials, those with the highest perceived supply reliability risks and those with the highest spend. This step typically involves extracts from your purchasing/ERP systems, augmenting this data with buyer and user assessments of criticality and supply risk. Gaps or errors in the source data may crop up – for example, country of origin or HTS code – and need to be corrected at the source. Focus next steps on these most critical items.

2. Understand how your company defines landed cost

Is there are recognized definition used for sourcing decisions? What is incorporated and what is missing? Standard cost typically doesn’t include all components of landed cost, but it is a starting point.

3. Consider cost accounting system changes

Work with your accounting team to address shortfalls in your ability to accurately measure landed costs on a timely basis. This will be well worth the effort given that corporate finance will likely be a key stakeholder in a major sourcing change. We have often seen landed cost spreadsheets developed and maintained by the supply chain organization, fed by accounting data and augmented with updated logistics costs and forecasts.

4. Work with your supply chain partners to provide timely information

In today’s environment, it is essential to have the best and most current freight and other logistics cost information. Your 3PL partners can be great sources of this information. And they can even deliver it on a scheduled basis for upload into ERP systems or costing spreadsheets.

5. Build landed cost-based analytics into your sourcing negotiations and decisions

Armed with timely information, you will be well prepared to identify and prioritize sourcing opportunities, analyze options, recommend changes, and build this knowledge into your supplier negotiations playbook.

Getting landed costs right has become more challenging and at the same time more critical. Take action now.

* * * * *

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com.

David Frentzel is a Partner at New Harbor Consultants. Dave brings 30 years of management consulting and hands-on executive leadership experience to improve business outcomes. Prior to joining New Harbor, he held various senior positions at 3PL and supply chain technology companies. Dave has extensive global management expertise helping companies with their global go-to-market, organizational, sourcing, manufacturing and supply chain strategies and operations.