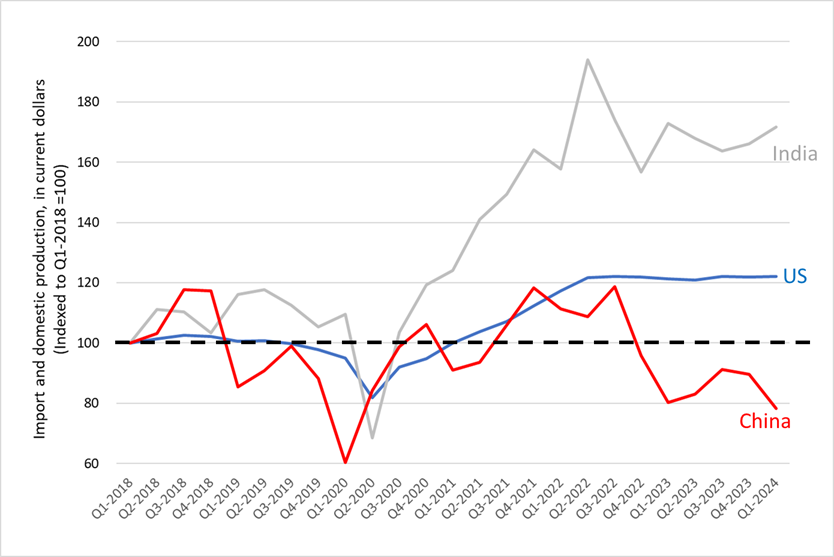

India sourcing is suddenly on everyone’s radar. Its manufactured goods exports to the US have shot up, taking share from both US domestic producers and Chinese imports (Figure 1).

Figure 1. India sourcing vs. China sourcing and US domestic production (Mfd Goods)

Note: US manufactured goods imports (import customs value, current dollars) and US manufactured goods output (current dollars), indexed to Q1 2018 = 100. In 2023, manufactured goods represent 97% and 94% of all imports (customs value, USD) for China and India respectively. Source: US Trade Online, U.S. Bureau of Economic Analysis (BEA), and New Harbor Analysis.

India sourcing of manufactured goods is still relatively small – only 21% of what we import from China and equivalent to just one percent of US production, in dollar terms. But rapid growth in the past four years reflects recent significant developments, such as Apple’s move to reduce reliance on China, India’s improved manufacturing capabilities and logistics infrastructure, and pro-economic growth policies under Prime Minister Modi (re-elected in June).

So, is the timing right for your company to explore sourcing opportunities in India? Now is a good time to do the research and thoughtfully consider your options.

Our thesis is that India today – despite its many challenges – is ripe for careful sourcing consideration. The search for offshore manufacturing that inexorably led to China these past 25 years must now be broadened to include a range of countries, from Mexico to Vietnam. India offers attractive possibilities for those willing to invest the time and money. Capabilities are now better, solid partners exist, quality can be good and the supply chain is reasonably reliable. That said, our Brief offers insights into how to explore the potential for India sourcing and then moving goods to the US market.

First, we’ll address why to consider India sourcing now, especially as a partial alternative to China. We will summarize broad developments in India – that we see as positive. We’ll use US import and production trends to show how India can fit into US companies’ supply base and identify those manufacturing sectors where India is strongest.

Then, we’ll turn to practical considerations. What are logical starting points in shifting sourcing from China to India? What are the options for Indian partners? How about logistics, from an Indian factory to a US distribution center? What are key watch-outs? We’ll share revealing charts and statistics, as well as practical advice from practitioners in India and the US.

Finally, we’ll provide a handful of cogent points on how to begin exploring India as a potential new sourcing opportunity.

Why India sourcing now?

The dramatic slowdown in US sourcing from China is the number one driver of current interest in India sourcing. Driven by political concerns, US tariffs, and the specter of pandemic-era snarled supply chains, many American brands are casting a broader sourcing net. Indeed, as we noted in a previous Brief[1], US imports from Mexico surpassed those from China last year.

India is clearly having a moment. It is now the most populous country in the world (as of 2023). It’s the largest democracy in the world. The country is exercising a more muscular and independent foreign policy, raising its geopolitical profile. India boasts the third-most billionaires in the world. It hosts excellent universities and a well-respected space agency. India has dramatically grown its outsourced web-enabled services. The Indian rupee has been slightly declining against the dollar. And English is widely spoken by business people, despite the presence of 22 official languages.

India’s logistics infrastructure – roads, rail, warehousing, and ports – has greatly improved in recent years. The Indian government has made the logistics sector a strategic priority, spanning on-the-ground infrastructure improvements and accelerating the adoption of technology to improve efficiency. New expressways and dedicated rail freight corridors aim to greatly reduce India’s notorious congestion (road and rail) and accelerate the movement of goods. Over the past six years, over-the-road container dray travel time from Greater Noida, just southeast of Delhi, to the west coast Mundra port has been cut in half, from four days to less than two. On the highly trafficked Delhi-Mumbai route, the freight corridor is expected to cut transit time roughly in half. As freight moves between states, tax payments and inspection forms have been digitized and on-board vehicle electronic toll collection on India’s national highways (FASTag) has now reached near universal adoption.[2]

The private sector is also stepping up. Ocean carriers are acquiring or partnering with local terminal operators and logistics operators. All these steps are improving export shipping capacity and efficiency, reflecting strong recent and expected continuing growth in Indian goods exports.

The dramatic increase in India’s exports reflects both global sourcing dynamics and tangible improvements on the ground. Since 2014, India has moved up from 54 to 38 out of 139 countries on the World Bank’s Logistics Performance Index, a higher ranking than either Vietnam or Mexico, though still well behind China. Plans are in the works for a new $9 billion deepwater port near Mumbai that aims to handle up to 23 million TEUs annually by 2040.

Ocean links between India and the US have also improved. Inbound to Savannah, for example, the average transit time is actually slightly faster for container services from Mumbai than it is from Yantian, China (38 vs 40 days, per data from the Georgia Ports Authority). There are four weekly calls from India vs nine from China on these specific port pairs. China, of course, retains a major sailing time advantage on lanes to the US West Coast.

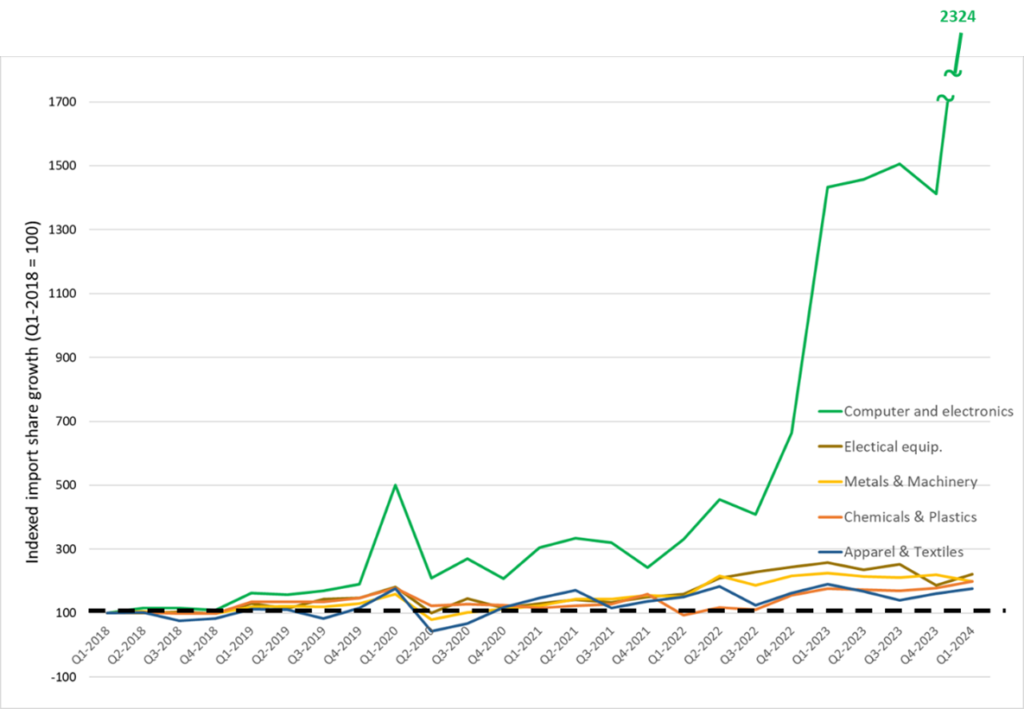

These developments have fueled India’s export growth in recent years, eroding China’s US export share. Most dramatic has been the huge growth in India’s computer and electronics exports to the US (Figure 2). Companies like Apple and Samsung have long viewed India as an increasingly attractive high-tech manufacturing base for both exports and for local and regional markets. And Google recently announced plans to begin making Pixel phones and drones in India. Walmart also is increasing its India sourcing, committing to buying $10B per year by 2027. That’s big – equivalent to over 12% of last year’s total Indian exports to the US[3].

Figure 2. Change in US manufactured goods import shares, from India relative to China

(For the top five commodities imported into the US from China)

Note: US imports from India as a percentage of those from China, indexed to 1Q 2018 = 100. Source: US Trade Online and New Harbor analysis.

While US companies are increasingly looking to India to reduce their reliance on China, India is at the same time highly reliant on Chinese manufactured goods imports. And India is pursuing Chinese technology and manufacturers to set up factories locally. Several of Apple’s component suppliers have set up operations in India and others will likely do so as well.[4] Thus fully decoupling from China will be a challenge whether sourcing is shifted to India, Vietnam or even Mexico.

Practical considerations for India sourcing

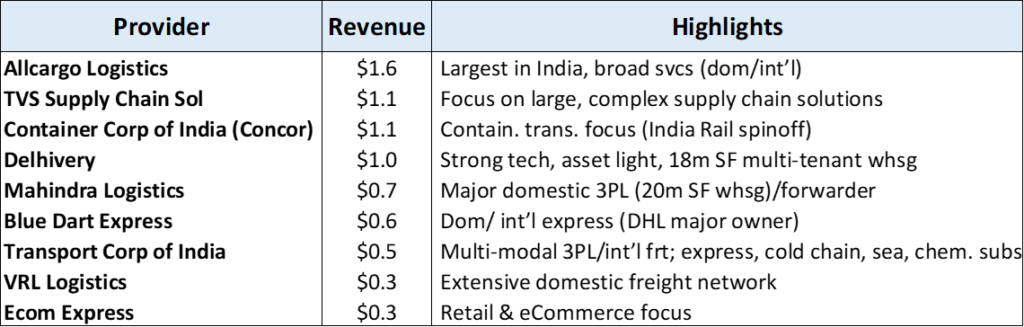

Partners – 3PLs & contract manufacturers

India has a well-established third-party logistics industry. Its revenues are estimated at $37B in 2023 and forecast to grow by 7% annually over the next several years.[5] The industry includes the major global 3PLs and a cadre of capable homegrown providers (Figure 3).

Figure 3. India-based 3PLs offer a breadth of services

Note: Annual revenue in USD billions for FY2024, excluding Ecom Express which is FY2023. Source: Logistics Outlook (India), The Economic Times, company websites, and New Harbor analysis.

The expansion of India’s export-oriented manufacturing sector is a significant tailwind for the Indian 3PL industry. Not surprisingly, the manufacturing and 3PL sector demand for warehouse space hit a record 23% YoY growth in the first quarter this year.[6] Moreover, the large integrators and forwarders are adding on-the-ground resources, acquiring or partnering with local providers.

For US companies seeking to source or manufacture products in India, working with a global or local 3PL can help navigate the opportunities and challenges of India sourcing. Your current 3PL may likely have such capabilities or has partners in the country. That is often a practical way to get started.

Your current contract manufacturers (CMs) may offer services in India and their own logistics capabilities or have established partnerships with local and global 3PLs. Major global hi-tech CMs have established operations in India – Flex, Foxconn, Jabil, and Sanmina, for example. Tata, the home-grown Indian tech and industrial powerhouse, is a major player as well, including manufacturing products for Apple in India. The Taiwan-based Pegatron is also active in India (also an Apple CM, along with Tata and Foxconn). Opportunities for leveraging the capabilities of CMs exist in other industries as well.

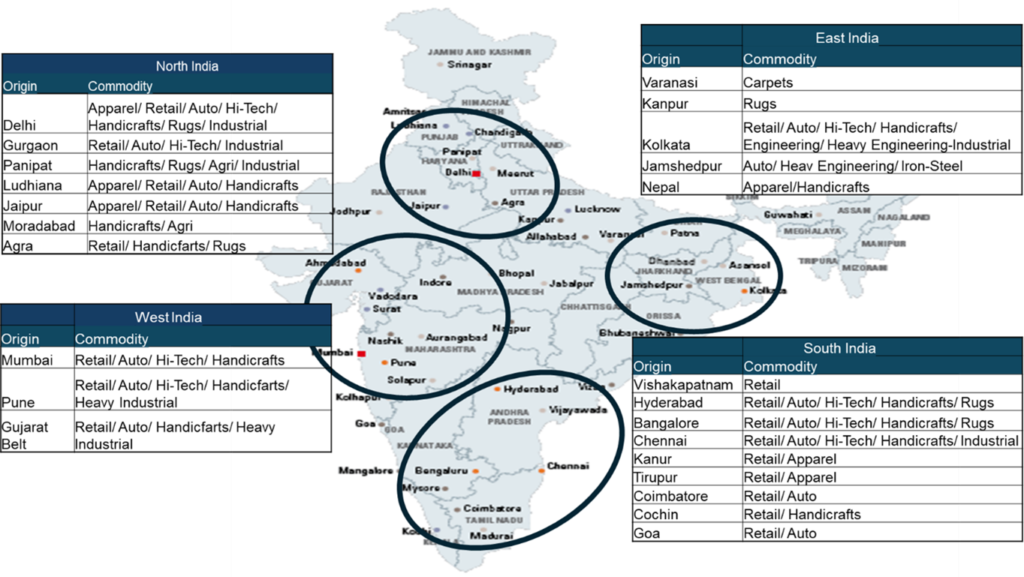

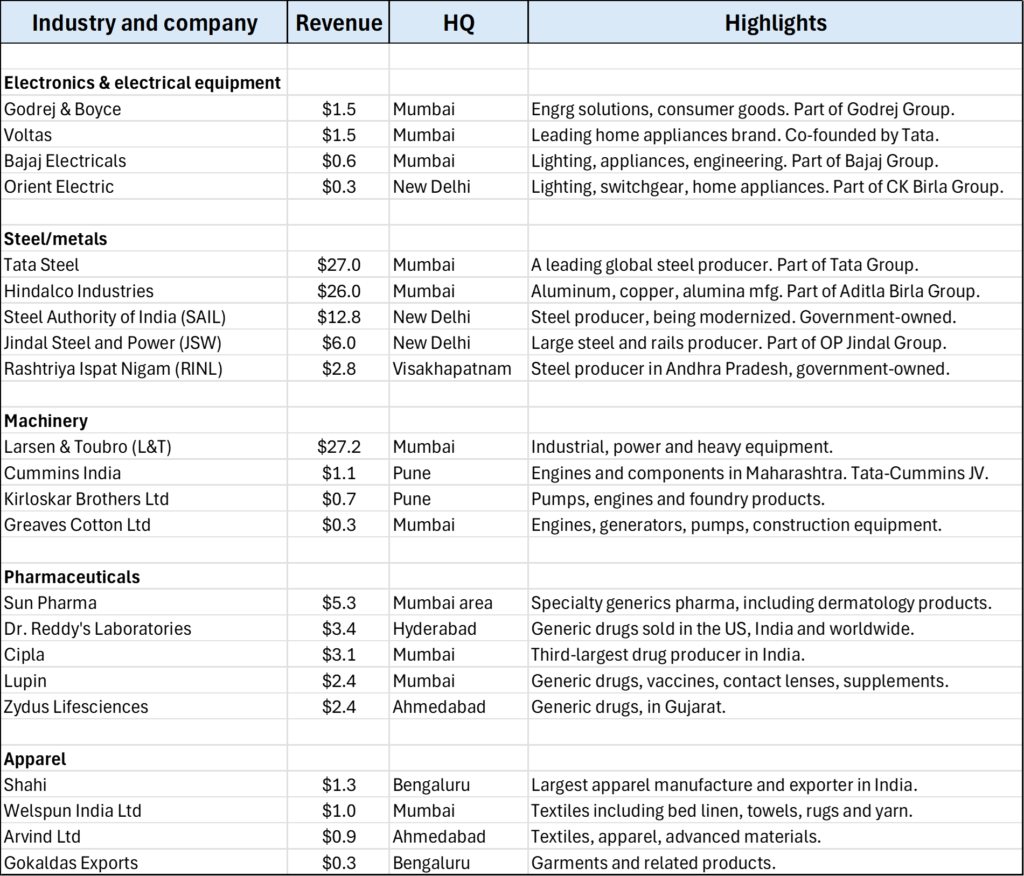

India is home to many significant manufacturers in key industries of potential interest to US importers, located in major industrial zones and cities across India (Figure 4). These range from mid-sized firms (some privately owned) to major corporations. For example, India has steel, pharma and garment manufacturers who are among the world’s largest. Contacting such companies can be part of your initial research to identify qualified Indian sources of components or finished products (Figures 5).

Figure 4. Major Indian industrial zones and cities

Source: i3 Networks Consulting.

Figure 5. Examples of potential Indian suppliers by industry

Notes: Revenue in $ billions (approximate – latest actuals) and highlights, from selected sources including company websites, themachinemaker.com, tofler.in, economictimes.indiatimes.com, companiesmarketcap.com and others. Figures not independently verified. i3 Networks Consulting and New Harbor Consulting analysis.

Other resources

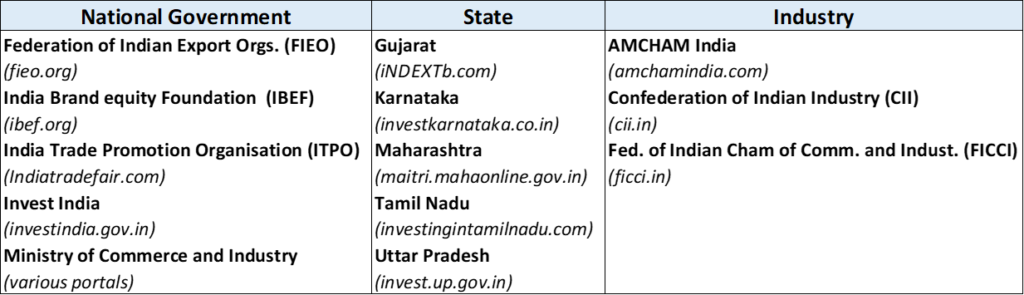

National, state and industry groups also provide assistance getting up to speed on business practices, and finding suppliers, CMs, and other potential partners in India sourcing projects (Figure 6).

Figure 6. National, state and industry resources that can assist with India sourcing

Note: These five Indian states represent 53% of India’s total manufacturing gross value add (GVA). Source: Annual Survey of Industries (ASI) 2021-2022, February 5, 2024, Indian Ministry of Statistics and Programme Implementation (MoSPI).

Where to begin with India sourcing

- Consider how India sourcing might enhance your global supply base

A great place to start is to examine your current supplier mix – with focus on both geographical and supplier-specific concentrations. How significant is your reliance on China? How well aligned are the supply sources with your end markets? Is the business case for your prior sourcing decisions still valid, or are costs and risks now out of kilter? - Select initial set of candidate products and markets

Armed with insights from previous step, we have found it helpful to validate hypotheses and estimate benefits using a handful of products. Research sourcing alternatives and, initially at high-level, calculate the potential benefits – cost, service, quality, and risk. Screening for the best opportunities will establish the merits of proceeding further and an attack plan can be developed. - Build an initial India-skilled team

You may find your internal team lacks hands-on experience to adequately explore India-based sourcing. Your 3PLs and contract manufacturers may be able to support you. Indian government and industry groups, as noted above, can help. Consultants can offer more detailed strategic and on-the-ground expertise.[7] - Launch pilot sourcing projects

A pilot project is often a practical, lower-risk and faster approach to getting started. Focus the project on just one or a few products. Driven by your initial analysis and screening, reallocate a modest portion of supply to the India-based suppliers, understanding the risks as well as the upside potential of the move. Be sure to establish KPIs and targets that define project success. - Assess results and prioritize opportunities

Analyze pilot data on India-sourced supply chain performance, around speed, reliability, delivered cost, management effort and quality. Gather input from internal stakeholders (e.g., sales, marketing, product quality, trade compliance) as well as your external partners. Seek senior management approval of the business case. Then develop implementation plans, as warranted, to expand India-based sourcing. - Contract with capable manufacturing and logistics providers

For small and medium-sized companies, CMs and logistics providers are often the best starting point for introducing India into your supply chain. Vendor screening and selection roadmaps will be needed. Be sure to consider the resourcing requirements to drive these initiatives through to vendor contracting.

A rapid diagnostic project can jump start the process, completing the first two steps above and providing recommendations and action plans. Consultants can help define pilot projects and accelerate progress with vendor search and screening, choosing pilot products, building the business case and conducting the sourcing process.

Conclusion

Now is a great time to take a fresh look at India sourcing. Even if you already have Indian operations, recent developments and tailwinds may offer opportunities to realign or expand your footprint – with supplier partnerships, logistics providers, international routings, and your own talent base.

Is India the next China? An interesting question. But for supply chain professionals, a more relevant question is: Is it right for my company now? Let’s get started.

* * * * *

Co-authored by David Frentzel and David Bovet, Partners at New Harbor Consultants.

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com.

David Frentzel is a Partner at New Harbor Consultants. Dave brings 30 years of management consulting and hands-on executive leadership experience to improve business outcomes. Prior to joining New Harbor, he held various senior positions at 3PL and supply chain technology companies. Dave has extensive global management expertise helping companies with their go-to-market, organizational, sourcing, manufacturing and supply chain strategies and operations.

David Bovet is the Managing Partner at New Harbor Consultants. He focuses on helping clients translate their supply chain vision into practical results. David brings 30 years of experience in supply chain management consulting across a range of industries and geographies. Projects focus on strategic direction, operational improvement and hands-on implementation. He is the co-author of Value Nets: Breaking the Supply Chain to Unlock Hidden Profits, about the power of fast and flexible logistics-driven business models.

[1] Mexico nearshoring passes China offshoring, see https://newharborllc.com/2024/04/08/mexico-nearshoring-passes-china-offshoring/

[2] Sources: i3 Networks Consulting, IBEF.org (see Figure 6), and The New York Times, July 31, 2024.

[3] Walmart press release, February 16, 2024 and US Trade Online (total 2023 Indian manufactured goods exports to the US).

[4] The Economist, July 20, 2024. China was India’s largest trading partner in FY 2023/2024, surpassing the US.

[5] Times of India, July 17, 2023.

[6] Logistics Outlook (India), April 11, 2024

[7] New Harbor Consultants has extensive sourcing expertise and partners with i3 Networks Consulting for on-the-ground India resourcing.