Ports

North American ports continue to deal with the challenges of major supply and demand disruptions. The initial supply shortages and blanked sailings caused by the virus in Asia are now visible in published North American port volumes. Going forward, we expect the figures will also reflect the demand destruction caused by the lock-down measures in many US states. Importers – aside from grocery and medical goods – are canceling orders or seeking to delay container delivery. Congestion related to the initial buildup of empties at the ports due to blanked sailings is thus now being potentially exacerbated by a throughput slowdown of loaded containers.

Ports are recognizing the challenge and responding, for example, by seeking storage space and by taking measures to better manage drayage. Georgia Ports Authority is adding new container storage space at Garden City Terminal. GPA recently added slots totaling nearly 5,000 TEUs of space and by mid-April another 6,000 TEUs will go into service.

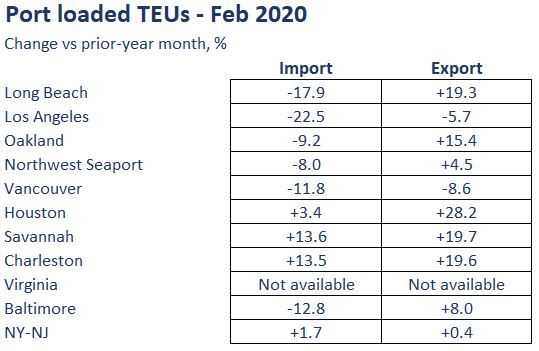

Statistics lag in painting this picture. In February (latest data now available, table below), the Pacific Coast ports already saw significant drops in import TEUs versus the year-earlier month – down about 20% in LA and LB. On the East Coast, volumes were still climbing in February (up nearly 14% in Savannah and Charleston); due to the longer sailing times from Asia, the supply shock hadn’t yet hit port data. Export boxes were generally up across the US, particularly from the Southeast ports.

Ocean carriers

Even as Chinese manufacturing is picking up, container shipping lines are struggling due to reduced demand for goods from the US and Europe, with most countries under some form of coronavirus stay-at-home orders. Blanked sailings between China and the US/Canada amounted to 940,000 TEUs in Q1 of 2020 versus just 370,000 withdrawn during the first quarter last year. And we expect blanked sailings to remain elevated in Q2.

Ocean carriers are resorting to extreme measures for cost cutting. CMA CGM announced it is routing its Asia-to-Europe strings around the Cape of Good Hope rather than through the Suez Canal. With low fuel prices, the operator comes out ahead by avoiding canal charges of $400k-$500k per transit. Since customers aren’t in a hurry to receive these containers, the perceived service impact is mitigated.

Intermodal rail

The movement of international and domestic containers by US railroads was down by 14% in the week ending March 28 versus the prior-year week (Association of American Railroads data). Month-over-month units have been down each month since April 2019, as US tariffs on Chinese imports and coastal shifts have eaten into intermodal volume. For the full month of March, US intermodal units were down by 12% in 2020 versus 2019.

Demand indicators

Demand is generally soft across the board at present. Credit card spending (Bank of America data) shows, as of March 24, all expenditure categories down, year-over-year, except for grocery and online electronics. Grocery, which had surged during the March 10-20 period, had calmed considerably by March 23-24.

The latest projections for US gross domestic product are bleak for the coming months. An unprecedented downturn of 35 to 40% is foreseen in the second quarter (Morgan Stanley, April 3). Recovery would then be strong in the third and fourth quarters but still leave US GDP down by 5.5% for the full year 2020. This would be the sharpest contraction in US economic output in more than 70 years.

The good news

Where’s the good news, you ask? There are several points of light in all this gloom. For example:

- About 85% of food consumed in the US is supplied domestically. Trucks are still running and delivering food and vital supplies to stores and households.

- The nation’s ports are open for business. They have been declared economically essential. Cranes and other equipment are so automated these days that it is mostly possible to maintain social distancing without curtailing operations (e.g., ports have adjusted morning work assignment protocols to take place outdoors in some cases).

- China is gradually ramping its manufacturing capability back up, as evidenced by both the official government PMI as well as the Caixin PMI in March – both of which leaped higher from historic lows in February. When demand recovers, there should be capacity to fill the need.

- There are opportunities for manufacturers, property owners and logistics providers to pitch in with innovative re-purposing of facilities and processes in support of medical equipment and supplies. Among many examples, small manufacturers at the Brooklyn Navy Yard are churning out masks and gowns. And a hockey equipment maker in New Hampshire that normally equips the NHL is producing plastic face masks for hospitals.

Longer term – what’s the new normal?

At this point, we can only guess at the longer-term ramifications of the COVID-19 outbreak. We can imagine widespread questioning of current supply chain configurations and inventory stocking policies. Possible longer-term shifts include holding more safety stock, in more dispersed locations, opening of second and third sources for companies that had sole-sourced products, and increased automation in warehousing. Major disruptions can accelerate trends that are already in place. The best current example is working remotely and substituting virtual meetings for face-to-face. Another megatrend is home delivery. Farther out, will cashier-less grocery and convenience stores become more common? The role of leading container ports, and port-oriented distribution centers, will evolve to serve these significant potential changes in global supply chains.

* * * * *

Contact us to explore how we can support your strategic, operational and investment needs: info@newharborllc.com.

David Bovet is the Managing Partner at New Harbor Consultants. He focuses on helping clients translate their supply chain vision into practical results. David brings 30 years of experience across a range of industries and geographies. Projects focus on strategic direction, market positioning, operational improvement and hands-on implementation.