Consumer brands have been badly buffeted, between supply shortages, shipping challenges and now weakening sales. Too little inventory or too much? Whither demand? Is supply assured? Supply chain (SC) management stands at the crosshairs of business success as never before.

New Harbor recently spoke with managers at a dozen small- to mid-sized companies. They talked about their SC priorities. We shared our experience running operations and advising management in this time of greater volatility. We offer here our thoughts on SC priorities to drive faster response via better supply, inventory, distribution and technology management.

Whipsawing demand during the pandemic and beyond

Many companies were caught short of supply during the pandemic, when demand for household goods skyrocketed after an initial sharp decline. Durables have been on a wild ride (Figure 1). Now, with price inflation and higher interest rates, consumption is rapidly moderating. Physical volumes sold are down in key sectors. Housing starts are down, Amazon is subletting warehouse space, office footprints are shrinking and Silicon Valley stalwarts are laying off staff.

Figure 1. US Durable Goods Spending, 2017-2022

SC Priorities for mid-sized companies

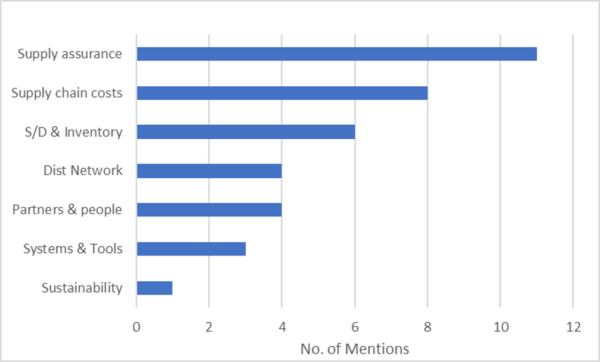

Earlier this year, New Harbor surveyed supply chain managers at a dozen small- to mid-sized companies, in collaboration with a leading private equity firm. We believe this effort may be more representative of widespread concerns in the US business world, focusing on smaller companies than the large publicly-traded firms often referenced in the press. A key question was, “What are your top supply chain priorities?” Supply-side challenges, both assurance of product and cost, headed the list (Figure 2). Maintaining the right inventory to balance on-hand stocks with demand was also a top concern. Other priorities involved distribution, partners & people, and the right tools. Sustainability, a significant consideration for many enterprises, came in at the bottom of this list, dominated as it was by immediate concerns.

Figure 2. Top 3 SC priorities for this year

In this Brief, we will address selected issues flagged in this survey and offer potential solutions. We are confident that these ideas can be profitably implemented by many smaller and mid-sized companies.

Supply side

Supply assurance and cost control are crucial issues today. Shortages ranging from cat food to computer chips roiled the US economy earlier this year. Recently, with producer prices rising at a 14 percent rate (year-over-year, September 2022), concerns about supply chain costs remain front and center.

We see two major approaches to better managing supply. The first is designing the right supply footprint. The second is best-practice supplier management.

Right supplier footprint. The pandemic revealed that many companies don’t have access to the right global footprint of suppliers. Covid-induced manufacturing shutdowns in China and exorbitant container freight rates across the Pacific flashed warning lights for many US brands. We worked with one of our clients to add Mexico-based supply to its China and Vietnam factories. Small US companies, such as obVus Solutions, a small ergonomic office equipment maker, have re-shored in recent months, building a manufacturing facility in Upstate New York – supporting an ability to respond rapidly to US market shifts. The principle of aligning regional supply with regional demand represents a fundamental move to reduce logistics costs and speed up product flows. Major corporations are keen on this move as well. Examples in the past six months include Lego’s announcement of its first-ever US plant near Richmond, Virginia, to serve North America and the planned joint venture by Honda and LG Energy to build a $4 billion battery plant near Columbus, Ohio.

Of course, it’s not only a question of where to source. We recommend choosing suppliers that correspond to a company’s needs, whether the emphasis is on quantity, quality, price or reliability. Size matters as well – finding a supplier with strong, relevant experience but not so large that it won’t give you the attention you want.

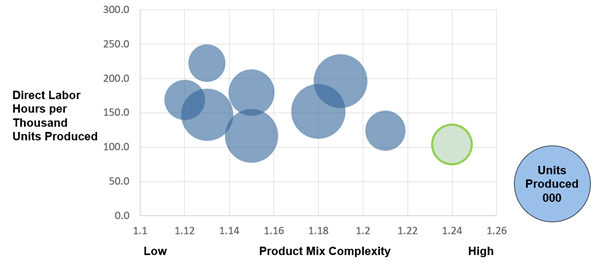

Better supplier management. Many companies don’t do a very good job of managing their supply partners, according to our survey. The pandemic often weakened the commitment to critical checkpoints such as in-person QBRs with senior management. Many mid-sized companies lack the Service Level Agreements (SLAs) required to drive strong performance. Analysis across facilities or providers can reveal surprising anomalies that call for a deeper dive into productivity differences (Figure 3). And a visual dashboard of the supply chain, with simple red-yellow-green indicators, can become a valuable tool for identifying bottlenecks and flagging issues for cross-functional management attention.

Figure 3. Cross-Plant Productivity Comparison

Supply-demand balancing

Demand levels will likely fluctuate considerably for many product types over the next few years. The question becomes how to best sync supply with rapidly-shifting demand. We offer two main approaches to better aligning supply and demand.

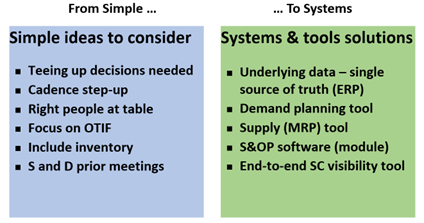

Adopting S&OP. The first is Sales and Operations Planning (S&OP). This concept is well-known and has been practiced by larger firms for decades. The process is newer for smaller firms, however, and a range of enhancements can offer big paybacks. Ideas for improvement range from the seemingly simple (shifting to a weekly cadence from a monthly frequency, for example) to deploying sophisticated software to support more effective decision-making. At our clients, these ideas have driven significant improvement in product availability and reduction of missed revenue (Figure 4).

Figure 4. S&OP Enhancement Ideas

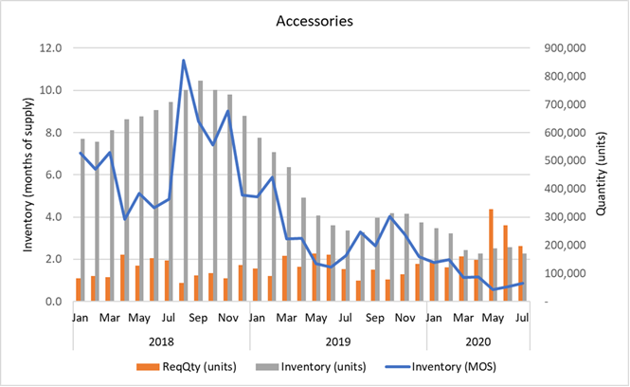

Optimizing inventory levels. The second point that can be better addressed by many mid-sized companies is inventory management. This is closely tied to S&OP – sometimes renamed “SIOP,” with an explicit inventory element. For smaller companies, the challenge is to obtain an accurate and timely view of inventory and to do a better job of planning optimal stock levels.

Companies lacking the right processes, data and tools can face chronic over- and under-shooting against inventory targets. At one company we worked with, months of pre-pandemic excesses were followed by shortages (Figure 5). Currently, inventories are again too high. This roller coaster is not uncommon, especially at smaller firms.

Figure 5. Inventory Management Challenges

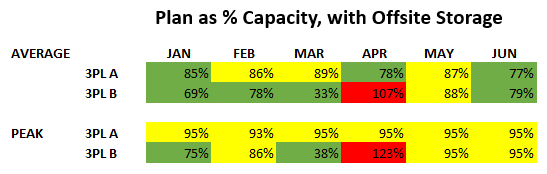

Ultimately, the right solution for such a problem likely involves new systems. But spreadsheet-based planning tools can also be powerful, to make critical decisions and to serve as a prototype for a more complete software solution. New Harbor developed a monthly warehouse capacity planning dashboard, for a client that was struggling to know how much warehouse space would be needed in the months ahead. Our tool (Figure 6) provided confidence for contracting additional storage facilities.

Figure 6. Warehouse Capacity Dashboard

Distribution

Getting product to market once it is received in the US is another great challenge, highlighted during the past couple of years. After successfully managing through overseas production cuts and the high costs and poor reliability of ocean service, many manufacturers and retailers found they faced major distribution problems within the United States. A major issue for most companies today is addressing omnichannel management. This is tied, more broadly, for younger but fast-growing brands, with the need to build out a national distribution network.

Omnichannel distribution. Newer consumer products companies have grown up with e-commerce. Yet they and longer-standing players must adapt to the challenges of managing across multiple channels. This results in a range of customer service requirements that makes a ‘one-size-fits-all’ supply chain design inadequate.

We have always been fans of segmenting customer fulfillment requirements and aligning supply chains accordingly. Today the range of these requirements is broader than ever. On the one hand, consumers have grown used to same-day or next-day service, thanks to Amazon. At the same time, some customers (in B2C or B2B environments) value extreme range of products, which cannot be economically stocked in every market. How to address this conundrum?

Solutions we have recommended and helped implement at mid-sized companies include: Activity-specific forecasting; discrete distribution networks to support Amazon vs the brand’s own e-commerce sales vs distribution to bricks-and-mortar stores; warehouse-within-a-warehouse, drawing on common inventory but employing distinct fulfillment processes; differentiating between baseload and seasonal peaks; and centralizing parts and slow-mover product distribution. The tradeoffs of service, inventory and operating cost are complex. It’s essential to know what each customer segment values in order to solve the equation.

Building out a national network. Smaller companies often grow up in a single city or region, with one or two warehouses that have sprouted over time in the same area. Several of our clients, for example, grew up with production and/or distribution facilities concentrated in Southern California. For products with a relatively low value-to-weight ratio, once the market becomes national in scope, logistics costs become significant. For such products, distribution costs can reach 15 percent of revenue, limiting margins.

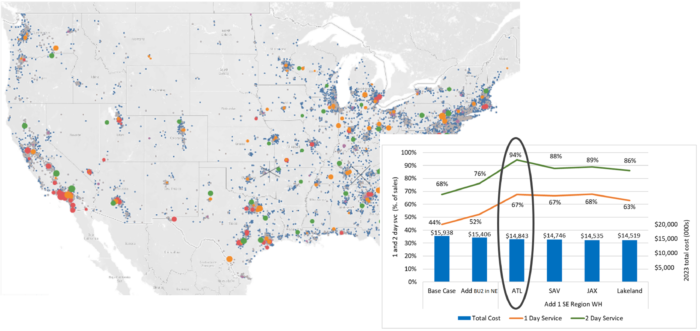

The solution lies in conducting a robust network analysis. The goal is to balance service, inventory and cost by customer segment. Careful assessment will determine where to place production, import gateways and distribution centers – potentially segmented according to customer requirements and product type. Further questions, such as whether to operate distribution facilities yourself or to rely on third-party providers, then flow from the structural network decisions. Accurate data on sales at SKU level, by customer and by location is essential to defining the correct answer (Figure 7).

Figure 7. Optimizing a National Distribution Network

Tools

Measuring supply chain performance (accurately and rapidly), planning ahead and managing operations day-to-day are all enhanced with the right technology. Dramatic advances have been made recently in the caliber and capability of supply chain management tools. The issue for smaller companies, however, can be what is the right platform? Something that can scale with growth but is not exorbitantly priced.

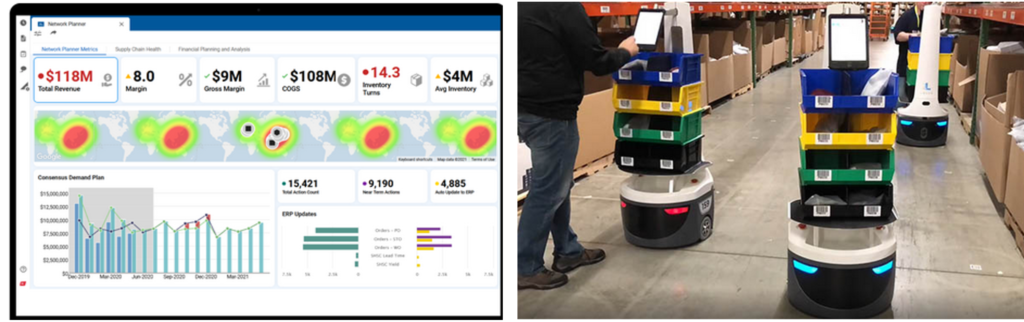

Technology for a disrupted world spans a broad range. Some of the most exciting new tools are visibility platforms (visibility, alerting, predictive analytics), outsourced logistics platforms (leveraging 3PL tech and execution capabilities), artificial intelligence (AI) and autonomous mobile robotics (AMR). The solutions exist (Figure 8) – the question is, what is right for your company?

Figure 8. Examples of New Tools

Ask yourself these questions, to help narrow the search for the most appropriate tools:

- How reliable and timely are ETAs from suppliers and 3PLs/carriers?

- Is real-time tracking at SKU/PO level available, for all vendors, modes and regions?

- Is this information leveraged for proactive alerting and decision-making?

- What is your labor productivity and per-unit cost, current and trending?

- Are suppliers and 3PLs actively bringing you the latest technology?

- Does your distribution network have the right balance of automation and labor?

Pointers – and actions to take now

The pandemic, recovery and pending recession reinforce five key pointers:

- The importance of supply diversity and assurance. As one company told us, “there is more risk in an Asia-centric manufacturing base than previously acknowledged.” To which we would add, supply aligned geographically with demand is critical, as is choosing the right partner.

- Inventory matters. “Just-in-Time and fixed safety stock levels break in volatile conditions,” according to one of the mid-sized players we surveyed. Getting levels right and adjusting rapidly to meet segmented demand is a major challenge.

- Building in agility. The cost of doing so is worth the investment, particularly in an environment where unpredictability and fluctuation are likely to predominate. This also means planning for the unexpected and having options ready to implement as needed. Time to recovery is a new metric and focal point.

- Better cost management.Many smaller companies could make better decisions if they had robust landed-cost methodologies. Sourcing decisions are distorted without this essential element in place.

- Strategic partners can be life savers. The right contract manufacturers and logistics providers are essential. This applies both to securing capacity in tight markets and to keeping costs under control in inflationary times. These strategic relationships matter.

A great starting point for many small- and mid-sized companies is to conduct a rapid diagnostic of supply chain characteristics and performance. This work, which can be performed in a few weeks, will reveal which of these actions are most critical. Please let us know if we can help.

* * * * *

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com.

David Bovet is the Managing Partner at New Harbor Consultants. He focuses on helping clients translate their supply chain vision into practical results. David brings 30 years of experience across a range of industries and geographies. Projects focus on strategic direction, operational improvement and hands-on implementation. He is the co-author of Value Nets: Breaking the Supply Chain to Unlock Hidden Profits, about the power of fast and flexible logistics-driven business models.