The coronavirus pandemic has revealed startling deficiencies in many companies’ sourcing strategy and supply chains. Supermarkets were unable restock their shelves when demand for home basics like peanut butter and toilet paper surged [1]. Healthcare providers could not get adequate supplies of PPE and ventilators as the COVID-19 caseload increased and distributors and manufacturers struggled to find supplies, ramp up manufacturing, bring on sub-contractors, and source materials from alternative vendors.

For some companies and their customers, it was a sobering experience to see how lack of visibility and contingency plans [2], lean/just-in-time inventories, inflexible and highly concentrated factories, and overseas suppliers and manufacturers, particularly in China, exacerbated a supply crisis. Even in normal times, purchased inputs may constitute most of product cost and sourcing strategy can make or break the supply chain.

In this Brief, we present a sourcing strategy diagnostic framework. It can help you prepare a better sourcing strategy whether or not you’ve experienced a shock. The framework entails five modules. The objective within each is to baseline current practices, performance, and capabilities (people, process and systems), and to identify improvement opportunities.

Sourcing strategy evaluation – five diagnostic modules

- Spend & Supplier Profile

The diagnostic begins with the most fundamental information: what are you buying and from whom? Typical questions include:

- How much is being spent? For what? In which business unit?

- What is each supplier’s share of the spend? What share are we of the supplier’s business?

- What is the nature of the relationship?

- Are supplier contracts in place? What is the mix of contract vs spot buying?

- What are the service level agreements (SLAs) by supplier and commodity?

- What is the process for renewing contracts and bringing in new suppliers?

- How are the buying practices and pricing terms aligned?

- Supplier Performance Scorecard

The supplier scorecard measures absolute performance and performance relative to internal targets and external benchmarks. While product quality and order fulfillment metrics are the most common measures, increasingly scorecards track compliance to trade rules, strategic material regulations, data privacy, security, safety, environmental, sustainability and other corporate social responsibility policies and goals.

- What is the commodity sourcing strategy and how does each supplier fit?

- What are the main areas of focus and objectives for sourcing in the year ahead?

- How well are suppliers performing against objectives, SLAs and external benchmarks?

- What mechanisms are deployed to measure and track supplier performance and costs?

- How are the results used to improve quality, service and cost (total cost of ownership, TCO) performance?

- How are suppliers’ unique value-adds measured, e.g., innovation, new product development?

- How well does each supplier comply with internal policies, corporate governance, local rules/regulations and supplier agreements/SLAs?

- Risk & Resilience

In recent years, risk management [3] has taken a backseat to cost and efficiency considerations at many companies. This was made painfully clear in the pandemic when Chinese suppliers shut down or air cargo capacity from Europe evaporated overnight. Some supply risks cannot be entirely avoided, but agile sourcing can effectively mitigate them.

- What is the profile of suppliers and spend by country of origin, manufacturing site, distribution network? How concentrated is it?

- What visibility is there to second and third tier suppliers? What is the company’s total exposure to a region, country, raw material, or resupply route?

- Are there backup suppliers, factories, distribution centers, and transportation routes? Have these alternatives been tested?

- What are the procurement lead times, how rigid/flexible are they? What is the total end-to-end replenishment cycle time for finished goods?

- Are supply contingency plans in place within the company and at suppliers (and the suppliers’ suppliers?)

- Sales, Inventory and Operations Planning

A company’s sales, inventory and operations planning (SIOP) [4] processes seek to adjust supply or demand, set inventory policies and procure supplies accordingly, allocate available products and resources, and ultimately maximize both customer satisfaction and company objectives.

In the sourcing strategy SIOP diagnostic module, key questions include:

- How is sourcing integrated into SIOP processes?

- What inventory levels/days of supply are maintained (internally and across the supply chain)? How are inventory deployment decisions made?

- How is supplier performance impacting inventories/working capital and customer service/TCO performance?

- Is the supply base adept at supporting new product development and rollouts?

- Design Innovation

At times, sourcing may be highly constrained by the product design and custom materials specifications. Opportunities may lie in redesigning the product or material specs for more agile manufacturability and sourcing.

- Can unique or custom items be respecified to simplify the buy and increase commonality across products and company divisions? How many suppliers are capable of meeting the specification?

- Do the bills of materials allow for substitutions or alternative builds and routings?

- Can suppliers add more value? When, where and how?

- Is there too much reliance on suppliers for core design expertise?

Designing an improvement plan

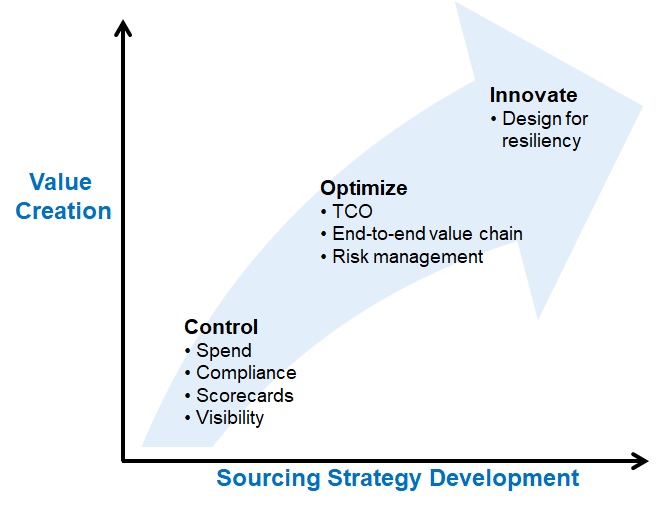

The sourcing strategy diagnostic provides a baseline to craft an improvement action plan aligned to sourcing value creation stages: control, optimize, and innovate. The first stage, control, forms the solid foundation for analysis and making informed decisions. As the foundation is being built out, initiatives to optimize sourcing decisions and increase sourcing resiliency can be launched in parallel, accelerating benefits.

What comes next?

We are often asked where to start. It may be in a specific division with the most critical challenges. In other situations, several diagnostic modules may be well understood, while others still require research. Or the company board may be asking a specific question, such as “How exposed are we to China?”

The sourcing strategy diagnostic is just the beginning. The resulting awareness and insights enable developing a roadmap for “quick win” improvements and more comprehensive change programs, typically spanning sourcing strategy, process, systems and organization. At the same time, the diagnostic motivates additional initiatives across the broader supply chain, including product line simplification, pricing rationalization, manufacturing strategy, offshoring vs near-shoring and distribution network design.

* * * * *

Related Briefs:

- [1] Toilet paper: The pandemic paradox, and The food supply chain – What’s changed and what lies ahead?

- [2] Revisiting Supply Chain Contingency Planning

- [3] Supply chain risk and reward — A rebalancing imperative

- [4] Supply-Demand Balancing: Facts, Process, People

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com.

Dave Frentzel is a Partner at New Harbor Consultants. Dave brings 30 years of management consulting and hands-on executive leadership experience to improve business outcomes. Prior to joining New Harbor, he held various senior positions at 3PL and supply chain technology companies. Dave has extensive global management expertise having spent more than ten years living and working internationally helping companies with their global go-to-market, organizational, sourcing, manufacturing and supply chain strategies and operations.