Pundits and politicians are staking out opposing positions on the Trans-Pacific Partnership (TPP), signed on February 4th. This significant trade agreement is subject to ratification by its member governments over the next two years. If and when implemented, the TPP would slash import duties and reduce non-tariff barriers for thousands of products, favoring exports by its members to signatories such as the United States. Now is the time to explore these upcoming opportunities, in particular focusing on Vietnam as an increasingly attractive global manufacturing source and growing domestic market.

I was able to observe firsthand some of the new developments in Vietnam during my visit last month. I toured distribution facilities focused on exports and internal markets and observed operations at Vietnam’s largest container port, Ho Chi Minh City’s Cat Lai terminal. What I saw confirmed the picture of rapid industrial growth, improvements in productivity, growing logistics infrastructure, and the potential merits of sourcing or manufacturing in the country.

Background on the Trans-Pacific Partnership

The TPP includes twelve Pacific Rim countries (Figure 1). From a market size perspective, the group is dominated by the U.S. and its neighbors plus Japan. Only a select few developing nations are included, such as Vietnam and Malaysia in Asia, plus Chile and Peru in South America.

Figure 1: Trans-Pacific Partnership Member Countries

Trade within the TPP represents twelve percent of world cross-border commerce. Notably missing from the TPP are several leading Asian export-oriented economies located near or along the Pacific Rim: China, South Korea, Taiwan, Indonesia and Thailand. Excluded also are Vietnam’s neighbors, Cambodia and Laos.

Where Vietnam Fits in the Trans-Pacific Partnership

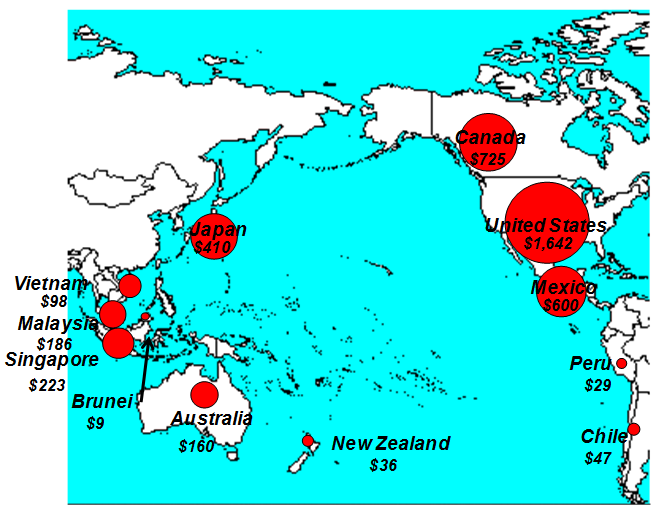

In 2014, Vietnam was the eighth-largest trading partner within the TPP as measured by dollar value of imports and exports among the group countries (Figure 2).

Figure 2: Intra-TPP Trading Volumes

(2014 imports and exports, in billions of USD)

Source: The International Monetary Fund (IMF). Chart depicts trade among the TPP countries only. Circle sizes are proportional to sum of exports and imports for each TPP country.

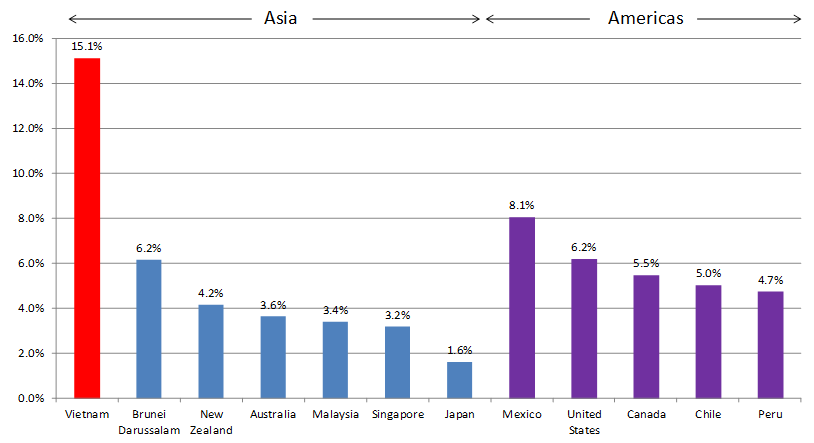

Vietnam has been the fastest-growing trading partner since 2010, handsomely beating Mexico, the second-fastest (Figure 3).

Figure 3: Intra-TPP Trade Growth Rates

(2010-2014 CAGR, %)

Source: IMF. CAGR growth reflects trade among TPP countries only, in nominal USD.

With its low wage rates, sizeable labor force, strong productivity gains, proximity to China (and rising wages there), and good logistics links (including low transpacific container shipping rates), Vietnam has built a formidable footwear and garment industry in the South. It is now aiming to establish similar capabilities and comparative advantages in the North in the hi-tech and industrial sectors. Leading electronics firms have launched or recently announced new operations in Vietnam, including Canon, Foxconn, Intel, LG, and Samsung.

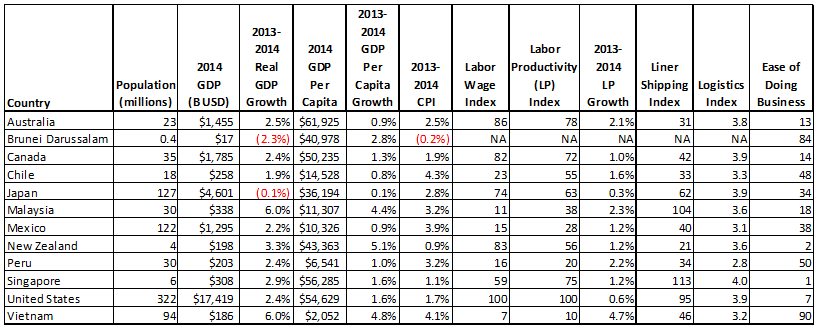

Compared to other TPP countries, Vietnam offers some of the lowest hourly wage rates and highest productivity gains (Table 1). With its solid Liner Shipping Index and Logistics Index performance ratings and an ease of doing business rating that’s better than India or Bangladesh (90 vs.130 and 174, respectively), it is not surprising that Vietnam has become a magnet for foreign direct investment.

Table 1: TPP Country Comparisons

Sources: The World Bank, The Conference Board, The Economist, and New Harbor Consultants.

Notes: The Liner Shipping Index (maximum of 100 in 2004, with a higher figure reflecting increased connectivity to global shipping networks) and Logistics Index (1 to 5, with 5 representing best performance across a range of logistics and customs functions in each country) are relative measures of the capabilities and performance in these respective areas. A lower Ease of Doing Business score means the regulatory environment is more conducive to the operation of business.

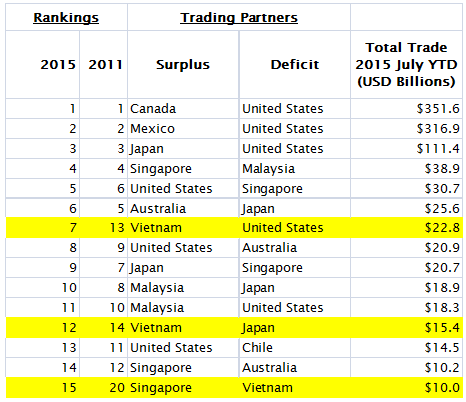

In intra-TPP bilateral trade, Vietnam’s top flow jumped from 13th to 7th largest between 2011 and 2015 (with the U.S.; see Table 2). In 2014, the top 15 bilateral trading relationships represented 91% of all intra-TPP trade, by value.

Table 2: Intra-TPP Trading Partner Rankings

(2015 (July YTD) vs. 2011)

Source: IMF, 2015 July YTD compared to 2011 rankings.

While Vietnam has strongly advanced its position within the TPP, China (not a TPP member) remains its largest supplier, providing US$49 billion worth of imports to Vietnam in 2015, an increase of 14% year-over-year. Vietnam still lacks extensive support/secondary industries and relies heavily on imports to fuel its export-oriented factories.

Like Singapore and South Korea which have both benefited economically from their numerous trade agreements, Vietnam has also adopted global free trade as a fast track to economic development. The country has recently entered into agreements with South Korea, the EU, and the Eurasian Economic Union, in addition to the TPP.

We expect footwear and garment production to continue to increase (including in the Northern provinces), despite growing wage and capability competition from Vietnam’s neighbors Laos and Cambodia, and from Bangladesh and emerging Myanmar. Assembly of electronics, machinery, and other industrial equipment and the manufacture of consumer products will also see increased foreign direct investment in Vietnam. At this stage, the country’s attractiveness is mainly based on its low-wage work force, so labor-intensive operations are the most popular.

Vietnam-Related Actions You Can Consider Now

The Government of Vietnam, its state-owned enterprises, and a range of public/private partnerships are in action mode – continuing to invest in the country’s logistics infrastructure. The goal is to enhance its competitive advantage globally, and in the spirit of the fifth objective listed in the Preamble to the TPP document: “…promoting the development and strengthening of regional supply chains.” Most notable is the development of the country’s export capabilities including industrial parks, a new deep-water port in the North to be completed in 2018, continued government divestiture/equitization of the transport sector, and a host of transportation infrastructure projects, both cargo- and public-transport focused.

In this environment, manufacturers should take a fresh look at Vietnam in the context of their global sourcing and manufacturing strategies. Third-party logistics (3PL) providers need to lead the charge by investing in capabilities to help their customers take advantage of the opportunities unfolding in Vietnam. This would include the acquisition of, or partnership with, local logistics providers. All modes of investment in the logistics sector, ranging from wholly foreign-owned operations to joint ventures, are now permitted in Vietnam.

Manufacturers should:

- Understand the fine print of the TPP as it relates to specific industries and commodities – the tariff advantage will depend on the product and on alternative sourcing locations;

- Include Vietnam in strategic supply chain planning initiatives as sourcing and manufacturing points relevant to fulfilling demand locally, regionally and globally;

- Consider Vietnam’s growing per-capita GDP and domestic market for products in conjunction with export-oriented supply chain strategies; and

- Assess the cost, service and supply chain risks associated with Vietnam – such as transport reliability, capacity and rates; and relative merits compared to more localized sourcing (if seeking to meet customer demands in Europe or North America, for example)

3PLs should:

- Invest in building a global trade knowledge center of excellence to assist customers in understanding and leveraging the TPP and other agreements;

- Understand industry and customer-specific merits of global sourcing from Vietnam, today and once the TPP is ratified; and

- Develop a Vietnam market entry or service expansion plan, including partnering or acquiring local 3PLs, transporters, and freight forwarders

Investors should:

- Understand how the TPP might create opportunities or threats to their portfolio companies;

- Consider in-country growth opportunities as Vietnam’s economy expands and incomes rise for a larger middle class of potential consumers; and

- Seek acquisition targets within the TPP trading bloc or targets that will benefit from its implementation

TPP ratification is not a given in the U.S. nor the other member countries. Yet with or without it, Vietnam is well positioned for future growth. We recommend considering Vietnam as part of a global procurement, manufacturing or logistics service strategy. New Harbor’s professionals offer on-the-ground knowledge, domain expertise and analytical horsepower to help ensure that your supply chain benefits from the latest developments in the dynamic global trade and business environment.

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com

Dave Frentzel is a Partner at New Harbor Consultants. Dave combines his logistics and supply chain expertise with hands-on executive leadership experience to improve business outcomes. He has extensive global supply chain expertise having spent more than ten years living and working internationally helping companies improve their global go-to-market, sourcing, and supply chain strategies and operations. Dave’s experience spans a wide range of industries, working with companies in the after-market service, apparel, CPG, eCommerce, food & beverage, healthcare, hi-tech, and retailing industries.