In his recent Wall Street Journal Keywords1 column, Christopher Mims writes that the future of the Internet of Things (IoT) is about Services, rather than about Things. Indeed, for Third Party Logistics companies (3PLs) – service providers that have long linked disparate entities (suppliers, manufacturing sites, warehouses, transportation, retailers) – the emergence of “smart” things offers a new, high-potential business opportunity. By leveraging their recent investments in supply chain control towers, 3PLs are now strongly positioned to create new value for customers by extending services to a Control Tower of Things.

What are supply chain control towers?

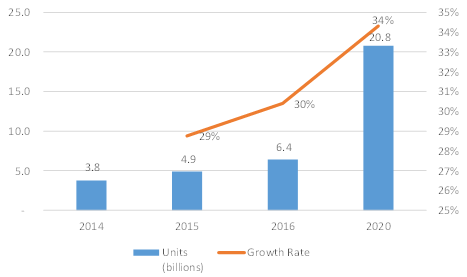

Globalized sourcing and manufacturing have spawned siloed organizations, facilities, decision-making processes, and information flows. This fragmentation has constrained manufacturers’ and retailers’ ability to effectively manage such elongated, complex supply chains. The solution, for leading-edge firms: Creating supply chain control towers that integrate the global supply chain with visibility and information at its core and add powerful analytics to improve supply chain execution, planning and strategy (Figure 1).

Figure 1: Supply Chain Control Towers

Source: New Harbor Consultants

Source: New Harbor Consultants

Leveraging their position inside a company’s supply chain and often touching many of its participants, major 3PLs have developed strong control tower offerings. Moreover, Lead Logistics Providers (LLPs) have emerged offering super control towers and enhanced decision support capabilities spanning multiple underlying 3PL networks. While supply chain technology companies and non-execution information service providers also offer control tower services and analytics, 3PLs and LLPs are uniquely positioned in that they can monitor, plan, optimize and execute the supply chain on behalf of their customers.

Control tower of things

For 3PLs, the IoT offers the opportunity to extend visibility and control tower services down to the level of things – however large or small or geographically dispersed they may be. In this way, rather than connecting just the traditional supply chain entities, these control towers will reach into (and collect information from) a single piece of industrial equipment, a consumer’s refrigerator, or even a part of the human body.

Remote management of connected things already exists in simple forms. Connected vending machines, for instance, transmit product inventory status to distributors so that delivery trucks can be optimally loaded and routed. But that technology and newer applications took time to adopt as the cost of communications and sensors declined. Now even smarter vending machines with cameras and other sensors can enable real-time decision making based on local conditions (weather, pedestrian traffic, facial characteristics, inventory status) to change screen advertising, enable local promotions, and dynamically price merchandise to increase sales. Self-diagnostic sensors and maintenance software can correct machine operating problems remotely or send part failure information to service providers and parts suppliers.

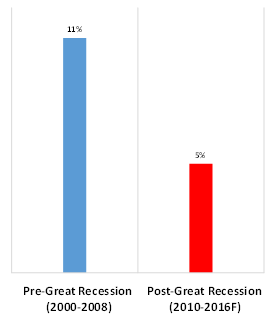

With the cost of devices and communications dropping, the number of connected things is projected to grow rapidly (Figure 2). Growth will be further fueled by advancements in data analytics and artificial intelligence, spanning all disciplines including logistics, enhancing the payback on the sensors, communications, and data management.

Figure 2: Number of Connected Things and Growth Rates

Source: Gartner, November 2015. All world estimates.

Note: 2015 and 2016 growth rates are year-over-year figures. The 2020 growth rate is calculated as the cumulative annualized growth rate from 2016 to 2020.

3PL position and opportunity

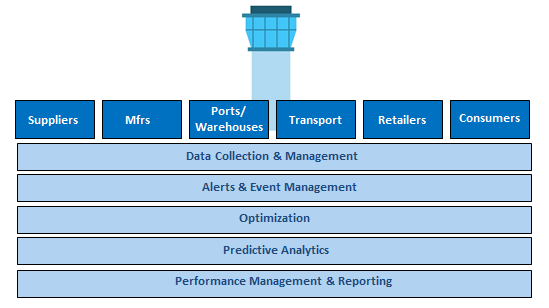

CSCMP’s 27th Annual State of Logistics report (June 2016) included IoT as one of several potential logistics industry disruptors. And where there is disruption there are new business opportunities. With the slowing growth of 3PL revenues (Figure 3) since the Great Recession, an expanded supply chain control tower product incorporating IoT in innovative ways offers 3PLs a means to create new value for customers and accelerate growth.

Figure 3: Annualized U.S. 3PL Industry Revenue Growth, by period (CAGR)

Source: Council of Supply Chain Management Professionals (CSCMP), Armstrong & Associates, and New Harbor Consultants analysis.

3PLs are well positioned to provide additional services based on the IoT. As an extension of mainstream supply chain control tower capabilities, 3PLs and LLPs already understand the value to customers of data aggregation and visibility across multiple supply chain entities. Now these things will become increasingly granular, such as an individual vending machine or a consumer’s cupboard. The real innovations will spring from using this granular and data-rich information layer to drive improved decision making in the supply chain. Think of dynamic optimization, alerts management, predictive analytics, and even artificial intelligence – at the level of an individual box of granola.

In the world of IoT, the new 3PL value proposition builds on the industry’s strengths: Creating this control tower know-how, staying close to customers, developing industry-specific solutions, partnering with IT providers, leveraging investments across multiple customers and industries, and reducing complexity and risk.

Competitors are already emerging to run the IoT supply chain control tower. Amazon, a 3PL of sorts and a lot more, offers IoT technology solutions through its Amazon Web Services business. It has introduced IoT-enabled automated merchandise replenishment solutions by means of its Dash Button devices, Dash Replenishment Service (DRS) device standards for developers, and a DRS fulfillment service. Industrial companies see opportunities as well. GE is creating an open source operating system for industrial equipment that connects, for example, equipment performance sensors to the maintenance supply chain via embedded predictive analytics. Tie-ups like Honeywell International’s offer to acquire the supply chain software company JDA, as recently reported, may well drive IoT supply chain control tower innovations in the marketplace.

Actions to consider

The IoT is still in its early days, despite an estimated six billion connected things by the close of 2016. Now is the time for 3PLs and LLPs to reassess industry and customer needs, product and technology strategies, strategic partnerships, implementation approaches, and organizational capabilities:

- Customer needs-based segmentation: What are my customers’ IoT strategies and plans? What IoT devices and applications will add value to my customers’ businesses and industries?

- Supply chain control tower product migration roadmaps: What product extensions and innovations will best address customer needs in the world of IoT? How can I create unique and differentiated products?

- Technology and partner selection: Are my existing control tower technology platforms scalable to and compatible with emerging IoT standards? Which partners can best support my new product roadmaps?

- Implementation approach: What early-stage customer and application pilot programs and rapid prototyping might improve product designs and accelerate product migration roadmaps?

- Organizational capabilities: Do my product development and product management teams have the skills and resources to innovate and the mindset to take the initiative and accept risks?

The IoT will surely be a disruptor relevant to supply chain management. Now is the time for 3PLs to define how this disruption can enable new and valuable solutions for their customers.

Endnotes:

1 Mims, Christopher. “The Internet of Things Isn’t About Things – It’s About Services.” The Wall Street Journal. 22 August 2016.

* * * * *

Contact us to explore how we can support your strategic, operational, and investment needs: info@newharborllc.com

Dave Frentzel is a Partner at New Harbor Consultants. Dave brings 25 years of management consulting and hands-on executive leadership experience to improve business outcomes. Prior to joining New Harbor, he held various senior positions at 3PL and supply chain technology companies. Dave has extensive global management expertise having spent more than ten years living and working internationally helping companies with their global go-to-market, organizational, sourcing, manufacturing and supply chain strategies and operations.